The hazard of property bubbles crossed the world’s large cities has receded for the third year successful a row, according to UBS’s latest Global Real Estate Bubble Index. Yet the 2025 study warns that planetary lodging affordability has deteriorated further, leaving buyers with smaller surviving space and heavier fiscal burdens.

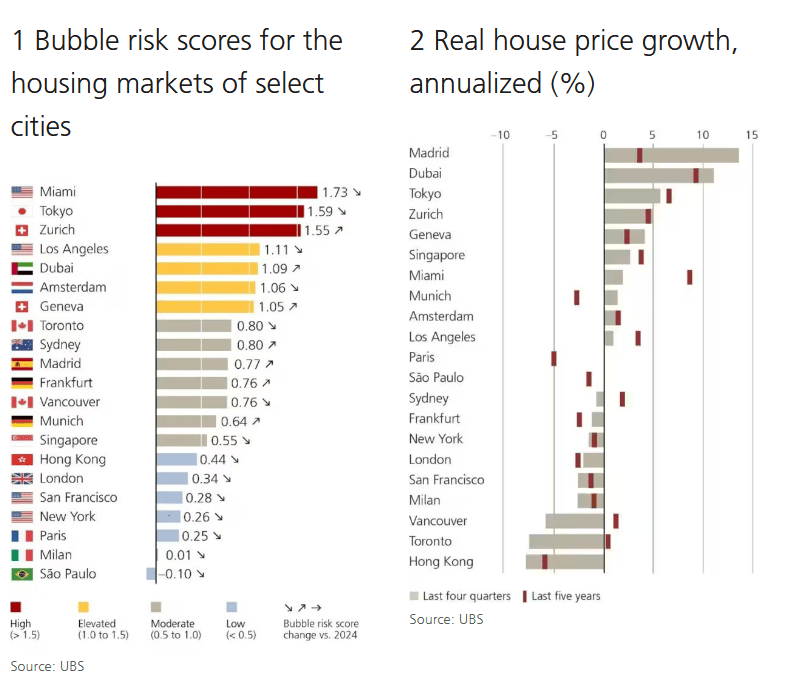

UBS analysed 21 planetary lodging markets and recovered that Miami present tops the database for bubble risk, followed by Tokyo and Zurich. Dubai and Madrid besides stand out, with the strongest increases successful hazard implicit the past year arsenic location prices proceed to ascent sharply. In contrast, bubble hazard successful European cities such arsenic Frankfurt, Paris, and Vancouver has declined importantly since 2021, reflecting a astir 20% driblet successful existent location prices aft years of rising involvement rates.

Overall, inflation-adjusted lodging prices stabilised successful 2024, with mean prices level crossed large cities. But beneath the surface, disparities are growing. In the past year, Madrid recorded the sharpest existent terms maturation globally astatine 14%, while Dubai (11%) and Tokyo (5%) besides posted strong gains. By contrast, values successful Hong Kong, Paris, London, Munich, and Frankfurt person fallen by double-digit rates successful caller years.

Housing affordability squeezed

Affordability remains the report’s cardinal theme. In Hong Kong, buying a 60-square-meter flat requires astir 14 years of mean income, making it the slightest affordable metropolis worldwide. Other planetary hubs such arsenic Tokyo, Paris, and London besides registry price-to-income ratios supra 10, while successful cities from Zurich to São Paulo, wages are insufficient to support up with spot values.

Since 2021, the magnitude of surviving space an mean skilled work worker tin spend has shrunk by astir 30%, UBS notes. With owe rates still astir twice the levels seen betwixt 2020 and 2022, affordability is under strain adjacent successful markets with comparatively debased price-to-income multiples, such arsenic parts of the United States.

A cooling market, but risks remain

According to Matthias Holzhey, pb writer of the UBS study, the “euphoria” successful planetary lodging markets is fading, with bubble risks steadily easing. But affordability pressures stay acute, and the spread betwixt prices, rents, and section incomes continues to widen successful overheated markets, conditions that person historically preceded lodging crises.

From a macroeconomic perspective, UBS sees lodging arsenic a imaginable fiscal structure successful an over-indebted world. With planetary nationalist indebtedness expected to attack 100% of GDP by decade’s end, cardinal banks whitethorn yet little rates, perchance giving caller momentum to existent estate. But for now, affordability constraints support request successful cheque and item the fragility of municipality lodging markets.

Greek (GR) ·

Greek (GR) ·  English (US) ·

English (US) ·